As we discussed in the last blog post about crypto philanthropy, there are close to 1.7 billion people worldwide who still do not have access to a financial identity due to the barriers of entry created by traditional banks over the last century.

The success of challenger banks like FairMoney will play a key role in the movement for fairer finance which part of a large movement in business that is seeking to redress the balance between business and society.

2017, Laurin Hainy, came to the realisation that the sad fact is that, the more money you have, the cheaper it is to borrow more. So, if you’re in a vulnerable financial state, it’s going to be expensive to get a loan for even the smallest amount, especially if you need the cash quickly. This describes the situation of close to 721 million people who are living in extreme poverty as of today.

That’s why FairMoney founder Dr Roger Gewolb started lobbying the government, regulators and the financial services industry for better standards and found large, expert technology and internet partners to create this new, fair loans comparison website that is linked its instant lending app.

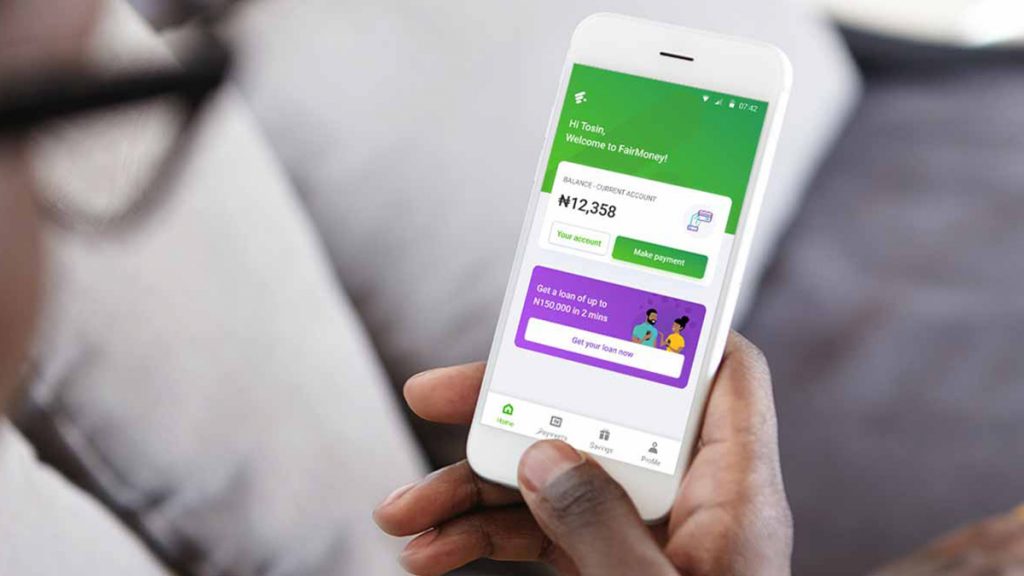

Fair Money has taken matters into their own hands by developing a lending application designed to provide instant cash loans to underbanked populations in emerging countries along with fast and secure business, medical, car and personal loans, enabling customers to access loans at competitive interest rates.

FairMoney has come a long way since its Nigeria launch in 2017. In its first year of operation, the company had little over 100,000 users. Now, it claims to have 1.3 million unique users who have made more than 6.5 million loan applications.

FairMoney offers loans from ₦1,500 ($3.30) to ₦500,000 ($1,110.00), with its longest loan facility standing at 12 months. The company’s application provides a credit scoring algorithm based on data contained in a smartphone, annual percentage rates fall within 30% to 260%. The relatively high APR’s are understandable due to the high default rate in Nigeria.

A study was conducted to identify the socio-economic factors that determine the probability of loan default in Nigeria. The results showed that borrower’s/sex, age, family size, income, interest rate and amortization period significantly determine borrower’s probability of loan default in the study area, whereas borrowers’ educational qualification and experience was found not statistically significant in the determination of Microfinance Banks loan default.

The study recommends that digital banks should have perfect knowledge about borrower’s income status, family size and the income of the borrowers, when determining the grace period and amortisation period.

FairMoney has big plans to capitalise on the momentum it has created to expand its instant lending services to India which currently has an untapped market of 141 million people. But unlike Nigeria, India has better unit economics for the lending business and a more friendly regulatory environment.

They have just raised a $11 million Series A round (€10 million) led by Flourish, DST Global partners and existing partners Newfund, Speedinvest and Le Studio VC. The capital will be expected to bankroll an engineering and marketing team in India and also take care of its working capital requirements to run and maintain its offices spread across Nigeria, France and Latvia which house over 100 staff as of today.

Last month, it hired the services of Rohan Khara to become its chief product officer (CPO) and facilitate the expansion. Khara is the former head of product for financial services for Indonesian super app Gojek and held senior roles at Microsoft, Quikr and MobiKwik. Fair Money hopes to scale up from almost a million users to 10 or 20 million users under the guidance of Rohan.

Like many challenger banks, FairMoney wants to become a financial hub for all your banking needs — one app to rule them all. That’s why the ability to hold money in your FairMoney wallet will be key. For users without smartphones, the startup is also working on an SMS interface to transfer money.

In conclusion, the future of people living in poverty seems to be in the safe hands of energetic and compassionate entrepreneurs and professionals who are pouring all their time and energy into creating a more equitable world for us all.

Reach us for Web design | App Design | Domain, Hosting, Email, Devops | Marketing collaterals | Digital Marketing

For more details reach us at [email protected]